How to Spot and Use the Dragonfly Doji Candle in Day Trading DTTW

Contents:

As shown below, the dragonfly doji has a similar appearance to the hammer pattern or capital letter T. In this article, we will look at the dragonfly doji, which is another popular type of the pattern. Allen and his team of professionals are actively working together to help the average retail trader become successful and profitable in the market. It formed this bearish engulfing pattern showing rejection of lower prices. If you notice, the market is above the 50-period moving average and it tends to bounce off it repeatedly.

Bitcoin Daily Dragonfly Doji Gives Bulls Hope Of Sharp Reversal – NewsBTC

Bitcoin Daily Dragonfly Doji Gives Bulls Hope Of Sharp Reversal.

Posted: Wed, 09 Jun 2021 18:20:27 GMT [source]

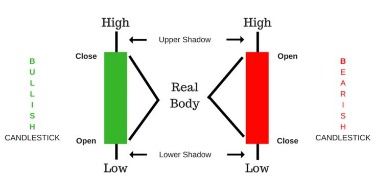

Dragonfly doji have no upper shadow and a long lower shadow, which suggests that bulls regained control over the price after strong selling pressure. When they occur after a downtrend, these candlestick patterns can predict a bullish reversal, especially if they occur on higher than average volume. First, you determine the timeframe, support, and resistance levels.

What is the Difference between a Doji and a Spinning Top?

The benefit of using such volume indicators is that they will help you know whether the price action is supported by strong volume. The lower shadows is considerably long compared to the body of the candle which is formed by the open and close prices. That means the open, high and close prices are very similar to each other, while the low price is proportionately far away from the trio. TrendSpider is a suite of research, analysis, and trading tools (collectively, the “platform) that are designed to assist traders and investors in making their own decisions. Our platform, its features, capabilities, and market data feeds are provided ‘as-is’ and without warranty. Dragonfly and gravestone doji can appear fairly frequently within a chart.

HaiKhuu runs some of the largest communities of stock traders on Facebook, Discord, and TikTok. With over a quarter-million retail traders in the HaiKhuu Trading communities, we have been able to help out hundreds of thousands of stock traders. As always, use the pattern wisely, in combination with other tools, to make informed and successful trading decisions. In Japanese, doji means “blunder” or “mistake”, referring to the rarity of having the open and close price be exactly the same. This creates a “T” shape that is easily identified by technical traders.

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-KGbpfjN6MCw5vdqR.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-Le61UcsVFpXaSECm.jpeg

Summing up, I would like to stress that the doji candlestick pattern is a reversal pattern that has different modifications. The price rolls back to the opening level by the end of a trading period. The market movement beyond the price range is the same in both directions, while the opening and closing prices are within the trading range.

Dragonfly Doji results

Because the lower shadow is so long and the closing price is pegged at the top of the candlestick, upward breakouts predominate. A frequency rank of 44 means it is more plentiful than many other candles, so you should see it often in a historical price series. Doji is a category of technical indicator patterns that can be either bullish or bearish.

A good example of a dragonfly doji pattern is shown in the four-hour EUR/USD pair shown below. As you can see the price was in a minor downtrend when the price opened sharply lower and then ended the day close to where it opened. The significance of the dragonfly doji is that it doesn’t appear too often, in comparison to other candlestick patterns. Counterattack lines are two-candle reversal patterns that appear on candlestick charts. A spinning top is a candlestick pattern with a short real body that’s vertically centered between long upper and lower shadows.

What is a Bearish Engulfing candle Pattern, and how does it work?

The https://g-markets.net/ represents a state of indecision about the future direction of the price movement of the security, which mostly leads to the trend getting reversed. A dragonfly doji is a bullish doji candlestick that signals a potential reversal upward after a prior downtrend. A dragonfly doji is created when the open and close are the same and there is a long lower shadow and no upper shadow .

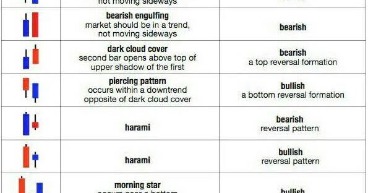

In a bearish reversal trend, the confirmation candlestick must be a bullish candle whose close is very clearly higher than the closing price of the Doji Dragon. A bearish candle will be a signal to continue or break the trend. The Dragonfly Doji is a relatively easy chart pattern to spot in the sense that the Japanese candlestick’s close price is equal to its open price. Apart from doji candles, you can also learn accurate candlestick patterns to reversal candlestick patterns at Indodax Academy. If dragonfly doji candle forms when the price is reaching a resistance, it shows temporary price reversal, but you should follow further price action to confirm it. Dragonfly doji candle and gravestone doji candlesticks are very similar, and we discuss the difference further.

The Dragonfly Doji is a Candlestick pattern that can help traders see where support and demand are located. It can be used with other indicators to identify a possible uptrend. The TC2000 dragonfly doji candlestick scan will return to you stocks that capture the essence of this classic candlestick reversal pattern. Price rejection from the support zone indicates that buyers are stronger than sellers and they will turn the bearish trend into bullish.

If the security is considered to be oversold, which may require the assistance of additional technical indicators, a bull movement may follow in the days ahead. This may be a chance for additional entry points, especially if the market has a higher open on the following day. The lack of a body on the candle is the reason why the books say pin bars have a higher chance of causing a reversal than dragonfly and gravestone doji candlesticks. In the next step, in particular, after determining the downward trend line, you can analyze the candlestick chart. You can see that, following a local correction up, the price chart draws the first reversal pattern, a dark cloud cover.

Whatever type of Doji you encounter in the markets usually means that the sentiment is mixed. Neither the bulls nor the bears had the upper hand by the end of the session, despite any price action. However, like all Doji, the Dragon Doji reflects some form of market indecision or hesitation. Thus, despite confirmation signals, the price may continue in the direction of the trend. To be valid, confirmation candlesticks must be accompanied by strong volumes.

Best strategies of using the dragonfly doji

As a category, they are best described as a transitional pattern rather than a reversal or continuation pattern. Specific types of Doji patterns – like the Dragonfly or the Gravestone – can signal a possible reversal in prices but are best used in conjunction with other indicators. The dragonfly doji is a solid trend reversal pattern that certainly should be part of your trading toolbox. A dragonfly doji is formed when the buyers in the market have essentially managed to push the session’s candle from a session low back to the session’s open price. A doji is a trading session where a security’s open and close prices are virtually equal.

Also, it has a long shadow down without a higher shadow on the upside. The evening Doji star is the opposite of the morning Doji star. A big bullish candle should be followed by a Doji one with a gap up.

Top 5 Types of Doji Candlesticks – DailyFX

Top 5 Types of Doji Candlesticks.

Posted: Wed, 22 May 2019 07:00:00 GMT [source]

dragonfly dojiindepth.com is not liable for any damages arising out of the use of its contents. When evaluating online brokers, always consult the broker’s website. Tradingindepth.com makes no warranty that its content will be accurate, timely, useful, or reliable. If you’re looking for a dragonfly doji confirmation, you should pay attention to its next candle.

- https://g-markets.net/wp-content/uploads/2021/09/image-NCdZqBHOcM9pQD2s.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-vQW4Fia8IM73qAYt.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/male-hand-with-golden-bitcoin-coins-min-min.jpg

- https://g-markets.net/wp-content/themes/barcelona/assets/images/placeholders/barcelona-sm-pthumb.jpg

Lawrence Pines is a Princeton University graduate with more than 25 years of experience as an equity and foreign exchange options trader for multinational banks and proprietary trading groups. Mr. Pines has traded on the NYSE, CBOE and Pacific Stock Exchange. In 2011, Mr. Pines started his own consulting firm through which he advises law firms and investment professionals on issues related to trading, and derivatives. Lawrence has served as an expert witness in a number of high profile trials in US Federal and international courts. Our aim is to make our content provide you with a positive ROI from the get-go, without handing over any money for another overpriced course ever again.

The long lower tail of the candlestick indicates that the sellers are in control and have flooded the market which has caused the downward price movement of the security in a certain period. At the end of the period, however, the closing price is equal or almost equal to the opening price. This Japanese candlestick means that there is a downward trend, and a bullish corrective movement followed this.

It is difficult to estimate the return of a trade that is made according to pure dragonfly doji analysis. Traders need to use other technical indicators or patterns to identify the proper time for an exit. They usually create orders right after the confirmation candlestick appears. A trader can long a stop loss below the low of a bullish dragonfly or short a stop loss above the high of a bearish dragonfly. Estimating the potential reward of a dragonfly trade can also be difficult since candlestick patterns don’t typically provide price targets.